Finding Affordable WICA Insurance in Singapore: What 'Cheapest' Really Means for Your Business

As a business owner in Singapore, managing costs is always a top priority. When it comes to mandatory expenses like Work Injury Compensation Act (WICA) insurance, it's natural to seek out the "cheapest" option available. However, in the realm of insurance, especially WICA, what seems like the lowest price upfront can quickly become the most expensive mistake.

So, what does "cheapest" really mean for your business when it comes to WICA insurance in Singapore? It means looking beyond just the premium amount and understanding the true value of adequate protection and reliable service.

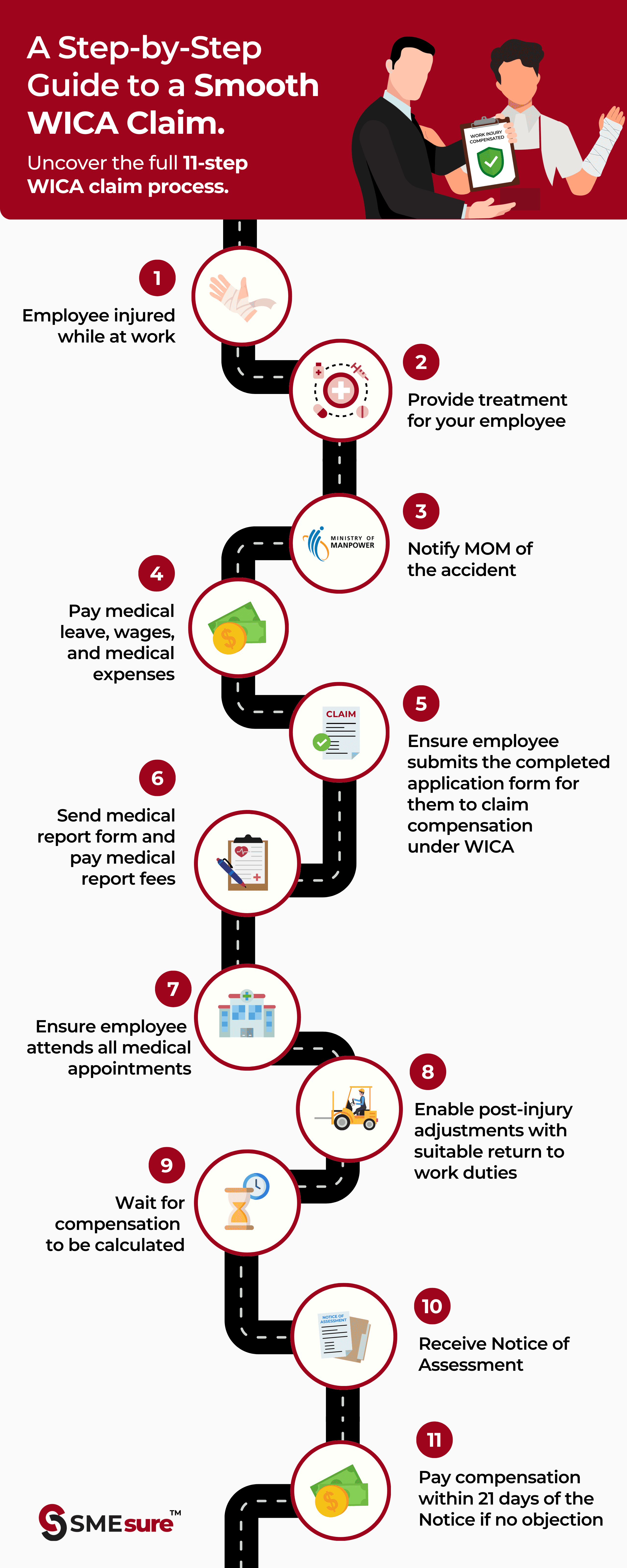

This article focuses on a specific aspect of WICA compliance. For a complete overview of coverage, employer obligations, and compensation rules, see our complete WICA guide for Singapore employers.

Why "Cheapest" May Not Be "Best"

Choosing the lowest WICA insurance premium can seem smart, but it often carries hidden risks:

- Adequacy of Coverage: Policies solely driven by the lowest premium may not offer comprehensive protection. This could mean limitations on medical expenses, lump-sum compensation, or specific types of injuries, potentially leaving your business responsible for substantial costs in the event of a serious incident.

- Quality of Claims Service: Insurers prioritizing rock-bottom premiums might have streamlined (or limited) claims handling processes. This could lead to extended processing times or complexities when an employee needs support, which might impact employee well-being and satisfaction.

- Ensuring Full Compliance: WICA insurance is a mandatory requirement by the Ministry of Manpower (MOM). It's essential that your policy fully aligns with MOM's stipulations for your specific business activities and workforce. A policy chosen purely on cost might inadvertently fall short of these critical compliance standards, potentially resulting in regulatory penalties.

What Makes WICA Insurance "Affordable" and Effective?

True affordability in WICA insurance means balancing cost with comprehensive protection and peace of mind. Here’s what to look for:

- Adequate Coverage Limits: Ensure the policy covers medical expenses, incapacitation benefits (medical leave wages, permanent incapacity lump sum), and death benefits sufficiently, in line with WICA guidelines. Don't compromise on the protection your employees are legally entitled to and deserve.

- Reputable Insurer: Choose an insurer with a strong financial standing and a proven track record for efficient and fair claims handling. A smooth claims process benefits both your employee's recovery and your business's operations.

- Compliance Assurance: Your insurer should help ensure your policy aligns with MOM's latest WICA requirements, helping you avoid hefty fines and legal complications.

- Risk Management Support: Some insurers offer value-added services or advice on workplace safety, which can help you prevent accidents and potentially reduce future premiums.

Factors Influencing WICA Premiums in Singapore

WICA premiums aren't arbitrary. Several key factors determine your cost:

- Nature of Business Activity: Industries with higher inherent risks (e.g., construction, manufacturing, F&B kitchens with machinery) typically have higher premiums than lower-risk environments (e.g., office work, retail sales).

- Number of Employees: More employees mean more potential claims, thus higher premiums.

- Employee Job Roles: Manual workers (e.g., kitchen staff, retail stockroom workers) generally attract higher premiums than non-manual workers (e.g., office administrators) due to higher risk exposure.

- Payroll / Earnings: Compensation for injuries is often tied to an employee's average monthly earnings, so higher salaries contribute to higher premiums.

- Claims History: Businesses with a poor safety record and a history of frequent WICA claims may face higher premiums.

- Safety Measures: Proactive workplace safety measures and a strong safety culture can sometimes lead to lower premiums over time.

If you would like a broader overview of WICA requirements, including who must be insured, the latest compensation limits, and how claims are assessed, refer to our ultimate guide to WICA in Singapore.

The Risks of Under-Insuring or Non-Compliance

If you choose a WICA policy solely based on the lowest price and it proves inadequate, or if you fail to comply with MOM's reporting requirements, your business could face:

- Direct Financial Burden: Paying for medical bills, lost wages, or lump-sum compensation entirely out of your own pocket.

- MOM Fines and Prosecution: Significant legal penalties for failing to comply with mandatory insurance and reporting obligations.

- Reputational Damage: Harm to your employer brand and employee trust, making it harder to attract and retain talent.

Finding the Right Balance: Strategic WICA Solutions with SMEsure™

For WICA insurance, "cost-effectiveness" transcends simply finding the lowest premium. It's about identifying the solution that delivers robust coverage, ensures full compliance, and provides genuine peace of mind – ultimately, securing the best value for your protection needs.

At SMEsure™, we recognize the critical balance between effective cost management and ensuring comprehensive protection for your employees in Singapore. We specialize in providing tailored WICA insurance solutions designed to offer extensive coverage at competitive rates.

Let SMEsure™ help you manage WICA and workplace risk with confidence. We support SMEs with coverage reviews, accurate job declarations, and MOM-aligned compliance so you can focus on running your business. Learn more at SMEsure™ WICA Support.

Share this article:

SMEsure™ is an innovative insurance technology company based in Singapore, focused on transforming how insurance fits into everyday life. By harnessing technology and building strong partnerships, we make insurance accessible and effortless.

Read MoreSubscribe to our newsletter for all the latest updates.

Any feedback or questions? Contact Us.

Follow our socials for quick tips & real-world stories.