What 'Under-Insured' Really Means: A Guide to Business Insurance for First-Time Owners

The first year of a new business is often a balancing act. Every dollar counts, and it can be tempting to cut costs wherever possible, including on business insurance. While it may seem like a smart way to save money, opting for the lowest premium often leaves a business dangerously "under-insured."

Being under-insured doesn't mean you have no insurance at all. It means your coverage is insufficient to protect you when a major claim hits. It's a risk that many first-time business owners take without even realizing it, often because they miscalculate the true value of their assets or the potential costs of a major incident.

The Dangers of Inadequate Coverage

The consequences of being under-insured can be far more costly than the premiums you saved.

One of the most common pitfalls is under-insuring your business's physical assets. For example, if you own a retail store and insure your inventory for $50,000, but a fire causes $150,000 in damage, you could be left with a substantial gap.

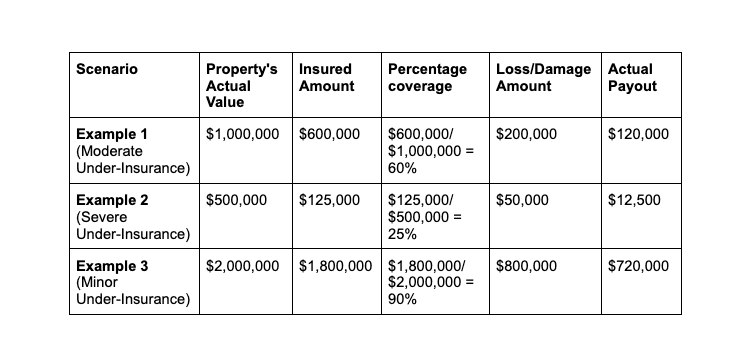

Many insurance policies in Singapore include an "Average Clause," which means if your property is under-insured, the insurer will only pay a percentage of the claim equal to your percentage of coverage. If you were only insured for one-third of your assets' value, you might only receive one-third of the claim payout, leaving you to cover the remaining costs out of pocket.

Even a simple slip-and-fall accident in your office could lead to a lawsuit, with potential medical costs and damages reaching hundreds of thousands of dollars. Adequate coverage protects your business from these unexpected liabilities.

A Real-Life Case: Public Liability

In a case detailed by the Legal Aid Bureau, a claim was settled for S$5,000 after an elderly man tripped over an unmarked, raised platform at a retail store. A separate High Court ruling highlighted that simply placing a "wet floor" sign may not be enough to escape responsibility if a shopper slips. These cases underscore that the burden of demonstrating every reasonable precaution rests on the business.

A Real-Life Case: Property & Inventory

A fire that broke out in a shophouse in Little India caused extensive damage, affecting neighboring shops. Without property insurance, the business owners would have faced significant financial loss from damaged stock, fixtures, and lost business income. For a small, new business, recovering from such a disaster would be incredibly difficult, if not impossible.

Common Reasons for Being Under-Insured

First-time business owners often find themselves under-insured for a few key reasons:

- Outdated Valuations: When a business's assets grow or their value increases due to inflation, the insurance policy is often not updated to match.

- Focus on the Minimum: Many entrepreneurs only purchase mandatory insurance (like WICA) or buy the minimum level of coverage required by a landlord, assuming it's enough.

- Overlooking Key Risks: A business might buy property and public liability but fail to consider modern risks like cyberattacks, which can result in significant data breach costs.

How to Avoid Being Under-Insured

Protecting your business from this hidden risk is straightforward with a proactive approach.

The best way to ensure you have adequate coverage is to work with an experienced insurance broker. They can help you conduct a thorough risk assessment for your specific industry and business model, identifying potential gaps that you might not be aware of. A good broker will also help you regularly review your policy as your business grows and its needs change, ensuring your coverage keeps pace with your success.

Take Action to Protect Your Business

Don't let a hidden risk compromise your hard work. Think of business insurance not as a simple expense but as a strategic investment in your company's longevity. It provides the peace of mind that allows you to focus on innovation and growth, knowing you are protected from the risks that could otherwise lead to financial ruin.

Contact SMEsure™ today for a comprehensive, no-obligation review of your business insurance needs. Ensure your coverage is adequate and protects your venture from the start.

For more information on how SMEsure™™ can support your business, visit us here.

For direct, one-on-one support and inquiries, you can also reach us via WhatsApp here.

Share this article:

Wilson is a seasoned Business Development spearheading strategic partnerships and business growth initiatives, leveraging his in-depth knowledge of the FinTech and InsurTech industries.

Read MoreSubscribe to our newsletter for all the latest updates.

Any feedback or questions? Contact Us.

Follow our socials for quick tips & real-world stories.