How to Get a WICA Insurance Quote in Singapore (and What to Look For)

As a business owner in Singapore, your employees are your most valuable asset. Protecting them is not just a moral duty, but a legal requirement under the Work Injury Compensation Act (WICA). With mandatory insurance for most employees, navigating the quotes and choosing the right policy can feel overwhelming.

This guide is designed to make that process simple and straightforward. We will walk you through the essential steps to getting a WICA insurance quote and reveal the key factors you need to consider beyond just the premium.

This article focuses on a specific aspect of WICA compliance. For a complete overview of coverage, employer obligations, and compensation rules, see our complete WICA guide for Singapore employers.

Step 1: Understand Who Needs to Be Insured

Before you get a quote, you need to know exactly who you are covering. Under the WICA, you are legally required to purchase insurance for:

- All employees perform manual work, regardless of their monthly salary.

- All employees performing non-manual work with a monthly salary of up to $2,600.

A Crucial Note: While WICA insurance is not mandatory for non-manual employees earning more than $2,600, you are still liable for their work-related injuries. It is highly recommended to extend your coverage to these employees to protect your business from significant financial and legal risks.

Step 2: Gather the Necessary Information

When you contact an insurer or broker for a quote, they will need specific details about your business to accurately assess the risk and calculate your premium. Make sure you have the following information on hand:

- Business Details: Your company's registered name, UEN (Unique Entity Number), and the nature of your business.

- Total Annual Payroll: The total amount of salary, allowances, and bonuses paid to all employees you are insuring.

- Employee Count: The total number of employees in your company.

- Job Roles and Duties: A breakdown of your employees' occupations. A high-risk job (e.g., construction worker) will have a higher premium than a low-risk one (e.g., an office administrator).

- Claims History: Details of any past work injury compensation claims filed by your employees.

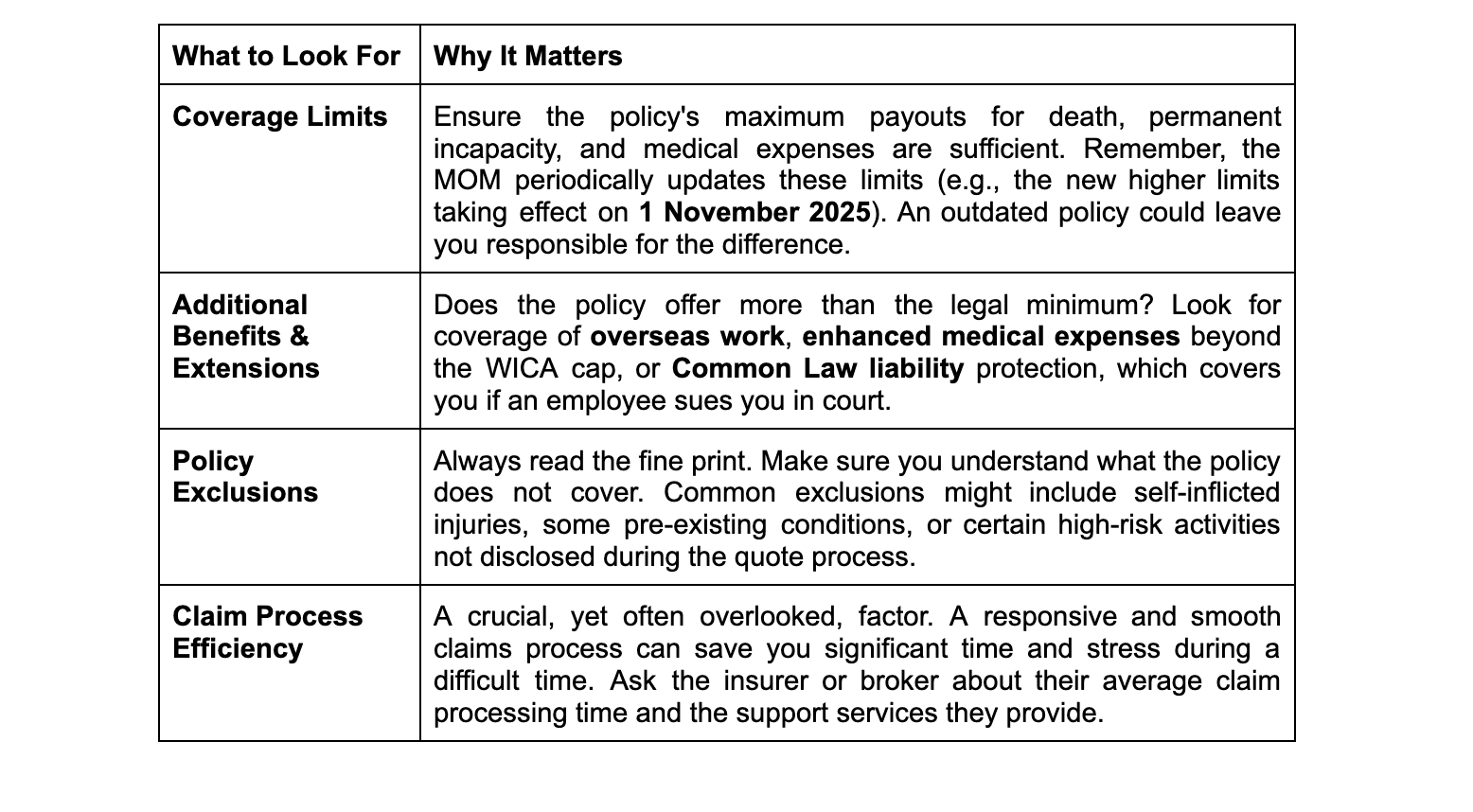

Step 3: What to Look For in a WICA Insurance Quote

The cheapest quote isn't always the best. A low premium may be a sign of inadequate coverage that could leave your business exposed in the event of a costly claim. Here’s what you should scrutinise in every quote:

If you would like a broader overview of WICA requirements, including who must be insured, the latest compensation limits, and how claims are assessed, refer to our ultimate guide to WICA in Singapore.

Common Mistakes to Avoid

- Under-insuring your employees: This could lead to a situation where your policy limits are exceeded, and you have to pay the remaining costs out of pocket.

- Not disclosing all information: Failing to provide accurate payroll or job role details can void your policy and result in legal penalties.

- Choosing a policy based on price alone: While affordability is important, the primary goal of insurance is protection. Prioritise robust coverage over a low premium.

By following these steps, you can confidently navigate the WICA insurance market.

Conclusion

SMEsure™ understands that finding the right insurance can be complex for Singaporean SMEs. We offer expert-driven, seamless risk management solutions, including comprehensive WICA insurance coverage that is tailored to your unique needs.

Our partnership empowers you to navigate complex regulations with confidence, protecting your bottom line and empowering you to focus on strategic business growth and your most valuable asset: your people.

Let SMEsure™ help you manage WICA and workplace risk with confidence. We support SMEs with coverage reviews, accurate job declarations, and MOM-aligned compliance so you can focus on running your business. Learn more at SMEsure™ WICA Support.

Share this article:

SMEsure™ is an innovative insurance technology company based in Singapore, focused on transforming how insurance fits into everyday life. By harnessing technology and building strong partnerships, we make insurance accessible and effortless.

Read MoreSubscribe to our newsletter for all the latest updates.

Any feedback or questions? Contact Us.

Follow our socials for quick tips & real-world stories.