Safeguarding WICA: How Singapore Employers Can Mitigate Fraud Risks in Work Injury Claims

The Work Injury Compensation Act (WICA) is a cornerstone of employee protection in Singapore, ensuring workers receive fair compensation for work-related injuries or illnesses, regardless of fault. This no-fault system streamlines claims, benefiting genuinely injured employees and simplifying processes for employers.

However, like any compensation system, WICA is not immune to the potential for fraudulent claims. Recent discussions have brought employer concerns to the forefront, with a rising demand for private investigation firms to verify the genuineness of work injury claims, as reported by Channel NewsAsia.

This trend underscores the significant financial scale of these claims: last year alone, 26,843 work injury claims were awarded, totaling a compensation payout of S$138.2million). For Singaporean employers, understanding how to mitigate fraud risks is crucial for safeguarding your business and maintaining the integrity of the WICA system.

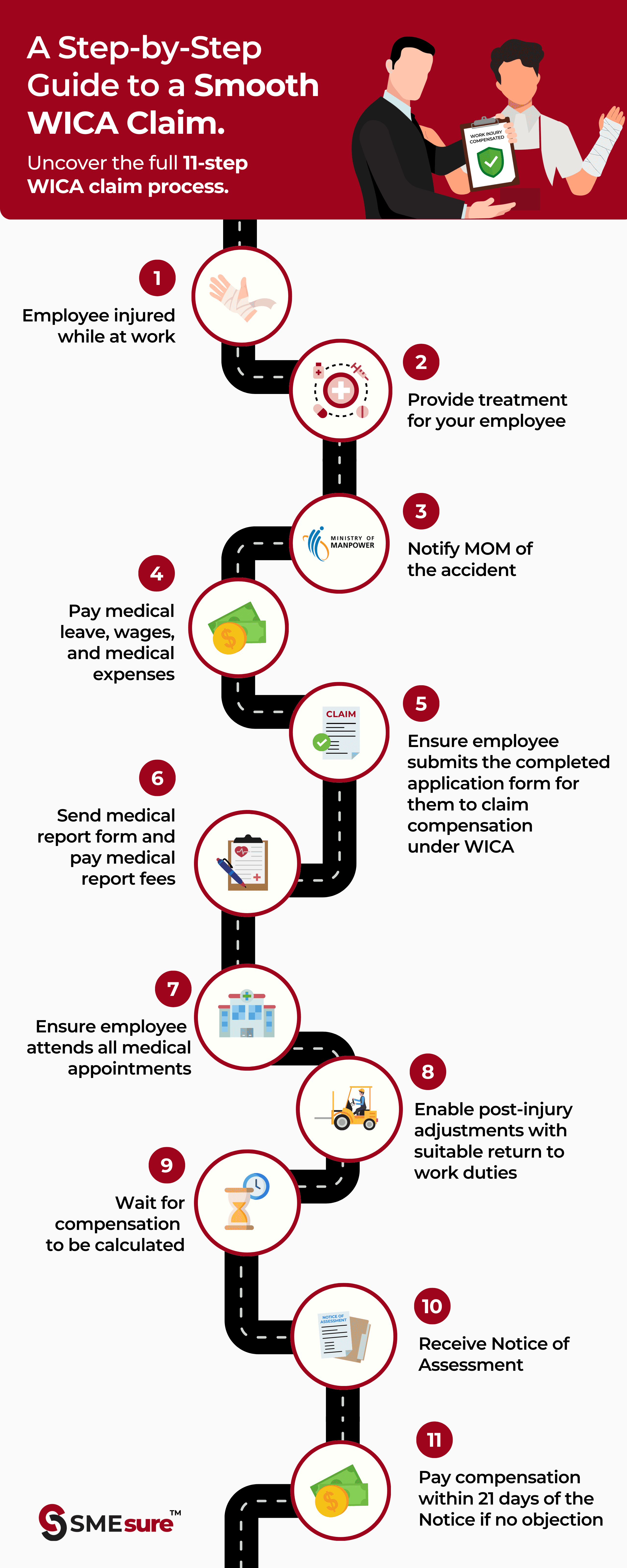

WICA requirements can affect employers in different ways depending on the situation. For a comprehensive overview of how the Act applies across scenarios, refer to our complete WICA guide for Singapore employers.

Understanding WICA and the Challenge of Fraud

WICA is designed for efficiency: if an injury is deemed work-related, the employee is compensated. This "no-fault" principle helps avoid lengthy legal battles over blame. However, this very principle can sometimes be exploited through:

- Exaggerated Injuries: Minor injuries are intentionally over-reported to prolong medical leave or increase compensation.

- Fabricated Accidents: Claiming a non-work-related injury (e.g., from home or leisure activities) occurred at work to shift financial responsibility.

- Malingering: Pretending to be sick or injured to avoid work, prolonging recovery time.

Such fraudulent activities are not only costly to employers (through increased WICA insurance premiums and lost productivity) but also undermine the system designed to protect genuine claimants. The Ministry of Manpower (MOM) takes a serious view of such abuses, and individuals found guilty of making fraudulent claims can face significant fines and/or imprisonment.

Key Strategies for Employers to Mitigate Fraud Risks

Proactive measures and diligent record-keeping are your best defense against potentially fraudulent work injury claims.

1. Prioritize Robust Workplace Safety & Training:

- Prevention is Key: The most effective way to mitigate risk is to prevent accidents in the first place. Implement comprehensive workplace safety protocols and provide regular training. A safer environment means fewer genuine claims, which indirectly reduces opportunities for fraudulent ones.

- Clear Policies:Ensure employees understand safety rules and immediate, proper accident reporting procedures.

2. Maintain Meticulous Documentation & Record-Keeping:

- Comprehensive Records are Your Evidence: Document every accident immediately and thoroughly, regardless of how minor. Include date, time, location, nature of injury, events leading to it, and witness details.

- Medical & Communication Logs: Retain all medical certificates (MCs), doctor's notes, and medical reports, checking for inconsistencies between reported injury and medical assessments. Keep a log of all communications with the employee regarding their injury and recovery.

- Witness & CCTV: Secure written witness statements promptly. If available, immediately secure and review CCTV footage for objective evidence.

3. Encourage Prompt Accident Reporting:

- Timeliness is Crucial:Insist on immediate reporting of all workplace incidents. Delays hinder accurate information gathering and increase discrepancy risks.

4. Vigilance and Observation (with caution and respect for privacy):

- Maintain regular, empathetic contact with injured employees. While respecting privacy, note any factual inconsistencies between their reported condition and observed activities. Avoid direct surveillance or harassment.

- Focus on the facts: Base any observations on factual discrepancies, not assumptions.

5. Leverage Your WICA Insurer's Expertise:

- Your WICA insurance provider is your primary partner in managing claims. They have established processes and expertise in investigating claims.

- Communicate Concerns: Promptly share all documentation and concerns about a claim's authenticity with your insurer. They can advise on next steps and initiate further investigation.

This is just one element of how WICA operates in practice. For a step-by-step overview of employer duties and compensation rules, refer to our ultimate guide to WICA in Singapore.

Navigating the Process When Concerns Arise

If you suspect a claim might be fraudulent or exaggerated:

- Do NOT Accuse Directly: Never directly accuse an employee of fraud. This can escalate the situation, lead to legal action against you, and harm morale.

- Gather Evidence: Systematically collect all relevant documentation and observations.

- Consult Your Insurer: Present your evidence and concerns to your WICA insurer. They have dedicated teams that are trained in fraud detection and investigation.

- Understand MOM's Role: MOM oversees WICA. In cases of suspected fraud, they can be involved in investigations and take action against false claimants.

Protecting Your Business While Upholding Fairness

Implementing these strategies is not about denying legitimate compensation; it's about safeguarding your business's resources and ensuring the integrity of the Work Injury Compensation Act for everyone. By mitigating fraud risks, you protect your company from unnecessary financial burdens and ensure that the system can effectively support genuinely injured employees. This proactive approach is a key part of effective risk management for every Singapore employer.

SMEsure™ understands the unique challenges Singaporean SMEs face. We offer expert-driven, seamless risk management solutions, including comprehensive WICA insurance coverage and support in identifying and addressing potential fraud.

This partnership allows you to navigate complex regulations with confidence, protecting your bottom line and empowering you to focus on strategic business growth and your most valuable asset: your people.

Let SMEsure™ help you manage WICA and workplace risk with confidence. We support SMEs with coverage reviews, accurate job declarations, and MOM-aligned compliance so you can focus on running your business. Learn more at SMEsure™ WICA Support.

Share this article:

SMEsure™ is an innovative insurance technology company based in Singapore, focused on transforming how insurance fits into everyday life. By harnessing technology and building strong partnerships, we make insurance accessible and effortless.

Read MoreSubscribe to our newsletter for all the latest updates.

Any feedback or questions? Contact Us.

Follow our socials for quick tips & real-world stories.