The Ultimate Guide to Understanding WICA in Singapore

Workplace injuries are never something business owners plan for, yet they remain a reality for companies of all sizes. Whether you run an F&B outlet, a small logistics team, a growing e-commerce operation, a cleaning company, or a professional services office, workplace accidents can happen at any time. And when they do, the Work Injury Compensation Act (WICA) dictates the rights of your employees and the obligations of your business.

WICA plays a critical role in Singapore’s employment landscape. It ensures that employees receive fair compensation for work-related injuries, while providing employers with a structured, predictable framework to manage incidents and financial liability. With updated compensation limits taking effect in November 2025, and with medical and wage inflation rising, it is more important than ever for SMEs to understand how WICA works and what it means for their risk management.

This guide breaks down WICA in a way that is clear, practical, and easy to apply in real-life business settings. It explains who must be insured, how compensation is determined, what employers must do when injuries occur, and how SMEs can protect themselves from unexpected costs or legal issues. Examples from common industries help bring the concepts to life, making the guide useful whether you manage a team of five or a workforce of fifty.

1. What WICA Is and Why It Exists

The Work Injury Compensation Act provides a no-fault system for employees to receive compensation for work-related injuries or occupational diseases. “No-fault” means the employee does not need to prove negligence. The focus is on ensuring that injured workers receive timely medical care, wage support, and—if needed—compensation for long-term disability.

Before WICA existed, compensation often depended on proving who was responsible for the accident. This made the process slow, complicated, and sometimes unfair. WICA simplifies everything by applying a standard, predictable system that protects employees while keeping disputes to a minimum.

It serves two major purposes:

Protection for employees

Employees can claim compensation for:

- Medical expenses

- Lost wages during recovery

- Permanent incapacity

- Work-related death

This ensures that an unexpected work injury does not result in financial hardship.

Predictability for employers

WICA sets out:

- Clear compensation formulas

- Maximum payout limits

- Legal obligations

- Standardised processes

This prevents large, unpredictable lawsuits and allows employers to plan financially.

In essence, WICA provides a fair, balanced approach that benefits the entire employment ecosystem—workers, employers, and insurers.

2. Who Must Be Insured Under WICA

WICA insurance is not optional for many categories of workers. Some business owners mistakenly believe that only high-risk industries require it, but the requirements are broader.

Singapore law mandates that employers purchase WICA insurance for:

All manual workers

This applies regardless of:

- Job title

- Salary

- Employment status

- Whether they are local or foreign

The definition of “manual” is wider than most people think. It includes warehouse assistants, delivery riders, packers, cleaners, technicians, kitchen staff, assembly workers, and anyone performing physical tasks.

Even if an employee’s primary role is non-manual, performing manual tasks regularly can still place them into this category.

All non-manual employees earning S$2,600/month or less

This covers a large portion of SME workforces:

- Retail staff

- Customer service officers

- Administrative staff

- Telemarketers

- Junior operations support

- Junior design or marketing roles

Many employers underestimate how many employees fall under this requirement.

Kitchen environments present unique injury risks, from burns to slips and manual handling injuries. Employers in the F&B sector should understand how WICA applies specifically to kitchen staff. Our guide on WICA coverage for kitchen crews in Singapore breaks this down in detail.

Higher-risk roles (even above the salary threshold)

Insurers may still require WICA coverage because of the nature of work. For example:

- Someone handling chemicals

- Someone who drives for work

- Someone who regularly lifts heavy items

If the job scope carries inherent risks, insurers often classify it as manual in nature.

3. Who Is Not Covered Under WICA

Only a few groups fall outside WICA:

- Domestic helpers

- Uniformed personnel (SAF, SCDF, SPF)

- Genuine independent contractors

- Freelance workers who work project-to-project

However, employers should be cautious. The MOM often looks at actual working relationships rather than job titles. If a "freelancer" works fixed hours, uses your equipment, or takes instructions like an employee, WICA may still apply.

4. Consequences of Not Having WICA Insurance

Failing to insure workers who legally must be insured is a serious offence.

Penalties include:

- Fines up to S$10,000

- Imprisonment for up to 12 months

- Increased penalties for repeat offences

Additionally, the employer will be required to pay the full cost of compensation out-of-pocket, including:

- Medical expenses

- Wage compensation

- Permanent incapacity payouts

- Death compensation if applicable

A single serious injury can cost well into six figures. For SMEs, that kind of unexpected payout can threaten business continuity.

Many employers search for the cheapest WICA policy available, but lower premiums do not always mean lower risk. Coverage gaps and exclusions can create unexpected exposure later. We explain how to balance cost and protection in finding affordable WICA insurance in Singapore.

5. The Recovery Clause: Why Accurate Declarations Matter

Many SMEs are unaware of the Recovery Clause, yet it is one of the most important parts of WICA insurance.

The Recovery Clause allows an insurer to recover compensation payments from the employer if the employer provided inaccurate information during policy purchase.

Examples include:

- Under-declaring salaries

- Misclassifying job roles

- Not reporting workers who should be insured

- Downplaying manual tasks

- Omitting certain risk activities

- Inaccurate headcount declarations

The insurer will still pay the employee’s compensation, because it is legally required—but afterwards, it may bill the employer for the entire amount.

This often surprises SMEs who assume that paying premiums protects them completely.

Real-world example

A small logistics company insures its “dispatch coordinators” as non-manual office staff. However, some of them regularly help move parcels in the warehouse. When one suffers a back injury, the insurer investigates and concludes that the employee should have been declared as manual staff. The insurer pays the compensation but then recovers the payout from the employer.

This is why accurate declarations are critical.

Beyond identifying suspicious claims, employers can take proactive steps to reduce exposure and protect themselves throughout the claims process. This includes proper documentation, reporting discipline, and internal controls. Learn more in how Singapore employers can mitigate fraud risks in work injury claims.

6. Updated Compensation Limits (Effective 1 November 2025)

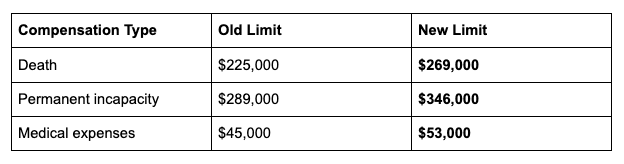

The compensation limits for WICA were revised to reflect rising wage levels and medical costs.

New 2025 limits:

These increases ensure fair protection for workers, but they also increase exposure for employers—especially those with gaps in coverage or inaccurate declarations.

WICA compensation limits are periodically reviewed and updated. Employers should stay informed, as these changes can affect potential liability and insurance planning. Our article on higher WICA compensation limits effective 1 November 2025 explains what has changed and what employers should be aware of.

7. How Permanent Incapacity (PI) Compensation Works

Permanent incapacity is one of the most complex areas of WICA, but breaking it down into parts makes it easy to understand.

Compensation is calculated based on:

- Average Monthly Earnings (AME)

- Age Multiplying Factor (AMF)

- Percentage of permanent incapacity

The formula:

PI Compensation = AME × AMF × PI%

Younger workers have higher AMFs because they have more remaining working years.

AMF Snapshot

Workers aged:

- 14 or younger → 181

- 26 to 35 → around 150–160

- 46 to 55 → around 110–134

- 66+ → 72

Examples that reflect common SME scenarios

Warehouse scenario

A 42-year-old warehouse worker slips while lifting cartons and suffers a spine injury.

- AME: $3,000

- Age AMF: ~140

- PI%: 25%

Estimated payout: 3,000 × 140 × 0.25 = $105,000

F&B scenario

A 23-year-old cook receives severe burns leading to noticeable scarring.

- AME: $2,400

- AMF: ~168

- PI%: 10%

Estimated payout: 2,400 × 168 × 0.10 = $40,320

Retail scenario

A retail assistant fractures a finger while unboxing stock.

- AME: $1,800

- AMF: ~155

- PI%: 3%

Minimum WICA amount applies → $4,850

These scenarios illustrate how even small injuries can lead to PI compensation.

8. What Employers Must Do When an Injury Happens

Even with insurance, employers have immediate responsibilities.

Get medical treatment first

Employers must ensure the worker receives prompt medical care. Delays may worsen the injury and affect the claim.

Pay medical bills upfront

Under WICA, employers must pay medical bills first and claim later from their insurer. Insurers do not pre-approve treatment before payment.

Report the incident within 10 days

This is mandatory. Late reporting can result in penalties.

Provide Medical Leave Wages (MLW)

If the employee is placed on medical leave due to a work injury:

- Hospitalisation leave is paid at 100% of earnings

- Outpatient MC is paid at 2/3 of earnings

These must be paid according to normal payroll timelines.

Maintain documentation

Employers should keep:

- MCs

- Medical invoices

- Salary records

- Witness statements

- Incident photos

- Communication logs

MOM relies heavily on documentation in case of disputes.

Some employers worry that reporting a workplace injury may trigger inspections or negatively impact operations, especially in higher-risk sectors. These concerns are common in the F&B and retail industries. We address them directly in WICA reporting for Singapore F&B and retail businesses.

9. Foreign Worker Coverage Requirements

Employers of Work Permit and S-Pass holders have two separate obligations:

WICA insurance (work-related injuries)

This is the same WICA coverage all employers must have.

Foreign Worker Medical Insurance (FWMI)

FWMI covers non-work-related injuries.The minimum coverage is $60,000, but many SMEs opt for higher limits due to rising hospital costs.

WICA + FWMI together ensure that foreign employees are covered regardless of whether the injury is work-related.

Purchasing WICA insurance is mandatory for many employers, but policies can vary significantly in coverage and terms. For a practical walkthrough of the process and what to review before committing, see our guide on how to get a WICA insurance quote in Singapore.

10. Practical Risk Management for SMEs

WICA compliance is the baseline. Proactive risk management helps SMEs avoid unexpected costs, reduce injury frequency, and protect workers more effectively.

Strengthen your policy coverage

Some businesses choose to add:

- Non-Act benefits (covers commuting or off-site injuries)

- Coverage for certain excluded scenarios

- Higher medical limits

This helps reduce unexpected exposure.

Document safety procedures

Documented SOPs help in two ways:

- Reduce actual injury risks

- Support the employer in case MOM reviews the incident

Improve workplace safety

Simple measures like safety briefings, clear signage, non-slip mats, and proper equipment handling training can reduce many common injuries.

Prevent fraud

Although uncommon, exaggeration and misreporting do occur. Consistent documentation helps prevent misunderstandings and protects both parties.

While WICA is designed to protect employees, employers should also be aware of cases where claims may be exaggerated or misrepresented. Understanding how such situations arise can help businesses respond appropriately without breaching their obligations. We explore common red flags and employer safeguards in our guide on workplace injury scams in Singapore.

11. Common WICA Questions from SMEs

1. Can an employee file a WICA claim even if they were careless?

Yes. WICA is a no-fault system, which means employees can still claim compensation even if the injury was caused by their own carelessness.

2. Is a freelancer covered under WICA?

Only if they function like an employee in practice. If the employer controls working hours, tools, or workflow, MOM may treat the freelancer as an employee — and WICA requirements will apply.

3. Does WICA cover injuries while working from home?

Yes, as long as the injury arises in the course of work. The key question is whether the activity causing the injury was work-related.

4. Can personal accident insurance replace WICA?

No. Personal accident insurance can complement WICA, but it cannot replace it. WICA is mandatory under Singapore law.

5. Does WICA cover commuting accidents?

Not by default. Commuting injuries are only covered if your WICA policy includes optional commuting or “Non-Act” extensions.

6. Can an employer dispute the PI percentage?

Yes. Employers, insurers, or employees may dispute the Permanent Incapacity (PI) assessment within 14 days of receiving MOM’s Notice of Assessment.

7. Do part-time employees require WICA insurance?

Yes. If they are hired under an employment contract, part-timers qualify as employees and must be covered under WICA where required.

8. Are interns covered under WICA?

Yes, interns are typically considered employees for the purpose of work injury compensation. They should be insured if they fall within WICA coverage rules.

9. Are directors covered under WICA?

If a director is also an employee drawing a salary and performing duties for the company, WICA insurance is required.

10. Does WICA cover mental health conditions?

Only if the condition results from specific work-related events, such as serious workplace trauma or recognised occupational diseases. General stress or burnout is not covered.

11. What if an employee refuses medical treatment?

Employees should comply with reasonable medical treatment requirements. If they refuse treatment, MOM may intervene or issue guidance based on the circumstances of the case.

12. Is salary during medical leave fully covered?

Yes, but with rules:

- Hospitalisation leave: 100% of average daily earnings

- Outpatient MC: 66% of average daily earnings

Employers must pay these as part of Medical Leave Wages (MLW).

13. Does WICA cover injuries during company events or team-building activities?

Yes, if the event is company-sanctioned or employees were required or encouraged to attend.

14. Does WICA cover injuries during lunch breaks?

Generally yes, if the injury occurs within the workplace premises during the break or while engaged in work-related activities. Off-premise lunch injuries are not usually covered unless optional extensions apply.

15. What if an employee is injured while performing a task outside their job scope?

WICA still applies if the task was work-related or assigned by a supervisor, even if it falls outside the employee’s usual role.

16. Are foreign workers covered by WICA?

Yes. All eligible foreign workers are covered. Work Permit and S-Pass holders must also be insured under FWMI for non-work-related medical costs.

17. Can employees claim WICA compensation after leaving the company?

Yes. If the injury occurred while still employed, they can still file or continue their claim after their employment ends.

18. What happens if a company closes down before compensation is paid?

The WICA insurer is still responsible for the payout, which is why proper WICA coverage is essential for SMEs.

19. Are injuries caused by misconduct covered?

Generally no. Injuries resulting from proven self-harm, intoxication, or criminal behaviour are not compensable under WICA.

20. Does light duty count as medical leave for WICA purposes?

No. Light duty is not medical leave, but employers must still pay salary accordingly and record light-duty days correctly. They may affect compensation calculations.

12. Conclusion

The Work Injury Compensation Act is a cornerstone of Singapore’s employment framework. For SMEs, understanding WICA isn’t just about staying compliant with regulations—it’s about building a safer workplace, managing financial exposure responsibly, and ensuring that your employees are protected if an accident occurs.

With updated compensation limits in 2025 and evolving workplace practices, WICA is more relevant than ever. By understanding how the system works, ensuring proper insurance coverage, declaring job roles accurately, and responding correctly when injuries occur, SMEs can navigate WICA confidently and responsibly.

A well-managed WICA process strengthens trust, reduces risk, and forms the foundation of a safer and more sustainable business environment.

Let SMEsure™ help you manage WICA and workplace risk with confidence. Our team supports SMEs in reviewing coverage, avoiding misclassification errors, and staying fully aligned with MOM requirements. This allows you to focus on running your business while ensuring your employees remain protected.

Learn more about how SMEsure™ supports employers: SMEsure™ WICA Support.

Share this article:

SMEsure™ is an innovative insurance technology company based in Singapore, focused on transforming how insurance fits into everyday life. By harnessing technology and building strong partnerships, we make insurance accessible and effortless.

Read MoreSubscribe to our newsletter for all the latest updates.

Any feedback or questions? Contact Us.

Follow our socials for quick tips & real-world stories.