WICA Update: Higher Compensation Limits Take Effect 1 November 2025

The Work Injury Compensation Act (WICA) is Singapore's safety net for employees, but it's not static. The Ministry of Manpower (MOM) periodically updates WICA to keep pace with economic changes, wage growth, and healthcare costs. The most recent significant amendments introduced in 2020 and further changes planned for November 2025 have crucial implications for all Singaporean employers.

Staying on top of these changes is vital for compliance and to ensure your employees are adequately protected. Here’s a breakdown of the key amendments to WICA.

WICA requirements can affect employers in different ways depending on the situation. For a comprehensive overview of how the Act applies across scenarios, refer to our complete WICA guide for Singapore employers.

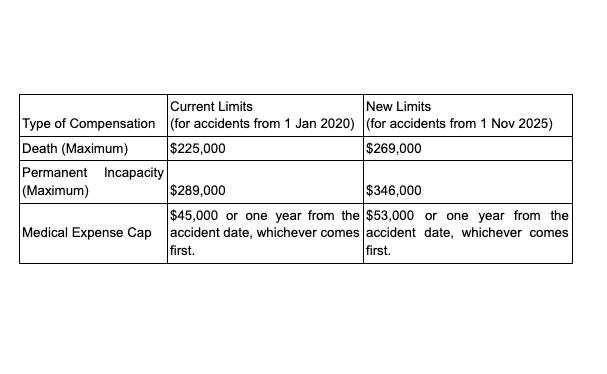

Increased Compensation Limits

To keep up with rising costs, the maximum compensation limits for serious injuries have been significantly increased.

These changes mean that employers must be prepared for potentially higher financial liabilities, making robust WICA insurance more critical than ever.

Expanded Mandatory Insurance Coverage

The WICA amendments have broadened the scope of who must be covered by mandatory insurance.

- Before the amendments, mandatory coverage for non-manual employees only applied to those earning up to $1,600 and working in a factory.

- From 1 April 2021, the new law requires you to have WICA insurance for all non-manual employees earning up to a monthly salary of $2,600, regardless of where they work. Employers must still insure all manual employees, regardless of salary.

This change means you may now be required to insure employees who were previously not covered under the Act.

Compensation for Light Duties

In a significant change aimed at preventing under-reporting of injuries, the new amendments now provide compensation for employees on light duties.

- Since 1 September 2020, an employee on light duties due to a work injury will be compensated for lost earnings based on their Average Monthly Earnings (AME). This ensures that an employee who cannot work overtime or receive allowances while on light duties is still fairly compensated.

Understanding this issue in isolation can be misleading. For the wider WICA framework, including employer responsibilities and risk considerations, see our ultimate guide to WICA in Singapore.

Compulsory Reporting of Medical Leave & Light Duties

To ensure a faster and more transparent claims process, the amendments introduced new reporting obligations for employers.

- Since 1 September 2020, employers must report all work-related medical leave or light duties to the Ministry of Manpower (MOM). This is a crucial step to prevent irresponsible employers from influencing doctors to under-prescribe medical leave and to ensure that all claims are processed automatically and efficiently.

Conclusion

The amendments to WICA signal a strong commitment from the government to enhance worker protection and streamline the compensation process. For employers, these changes underscore the need to review your WICA insurance coverage, ensure accurate reporting, and prioritize a safe working environment.

SMEsure™ understands the complexities of these regulatory changes and the unique challenges Singaporean SMEs face. We offer expert-driven, seamless risk management solutions, including comprehensive WICA insurance coverage that is tailored to your business.

Let SMEsure™ help you manage WICA and workplace risk with confidence. We support SMEs with coverage reviews, accurate job declarations, and MOM-aligned compliance so you can focus on running your business. Learn more at SMEsure™ WICA Support.

Share this article:

SMEsure™ is an innovative insurance technology company based in Singapore, focused on transforming how insurance fits into everyday life. By harnessing technology and building strong partnerships, we make insurance accessible and effortless.

Read MoreSubscribe to our newsletter for all the latest updates.

Any feedback or questions? Contact Us.

Follow our socials for quick tips & real-world stories.